Case Study: Policy Uplift in Healthcare

Scenario-based compliance training raised policy attestations from 54% → 91% within two audit cycles. Nudges, gamified micro-learnings, and anonymized feedback loops built…

Internal audit programs, interviews & investigations, financial/commercial due diligence, and ethics & compliance. Faster reviews, sharper findings, decision-ready packs.

Fact-finding that stands up to scrutiny: conflict checks, asset tracing, procurement leakage, whistleblower triage, background sweeps, and digital forensics.

Independent interviews of vendors, employees and partners to surface fraud, revenue leakage and control gaps — documented, defensible, and action-oriented.

Risk assessment, control testing, remediation tracking, and board dashboards. Co-sourced or turnkey, aligned to your 3LoD model.

QoE, working capital, revenue quality, and concentration risk. Red-flag heatmaps with management Q&A trails.

Policy design, training, hotline ops, third-party risk, and culture uplift. Practical frameworks with clear owners and SLAs.

Competitor scans, channel checks, pricing signals, policy watch. Decision memos that leaders actually read.

De-identified summaries. Details available under NDA.

Scenario-based compliance training raised policy attestations from 54% → 91% within two audit cycles. Nudges, gamified micro-learnings, and anonymized feedback loops built…

Automated contract comparison and billing variance analysis reduced reconciliation timelines by 28%. Finance teams gained a live dashboard for churn/ARR tracking and…

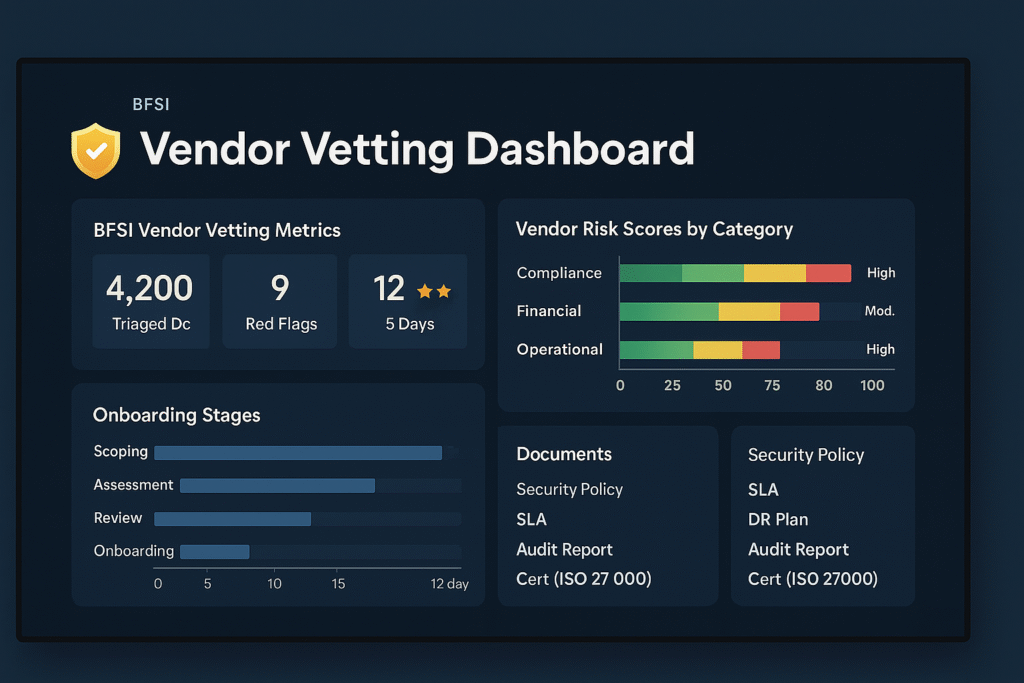

Challenge A mid-sized NBFC was onboarding 30+ vendors annually without a standardized due diligence framework. Vendor onboarding times averaged 6 weeks and…

Tell us your objective — audit cycle, investigation, or deal timeline — and we’ll propose a focused, time-boxed plan.